Let’s redress the gender imbalance in equity capital

If you’re an all-female team looking to raise venture capital, you’re only likely to get about 1% of the available pot. That’s only £1 in every £100 out of the multiple billions of available VC funding out there.

This stark research finding is part of a recent study by our campaign supporter British Business Bank. Their analysis also found that it’ll take an estimated – and staggering – 25 years before all-female teams are able to secure just 10% of available VC funding in the UK.

Our own research – Insights from Entrepreneurs – reveals that just over a third (36%) of women entrepreneurs has secured equity to scale their businesses compared with 82% of male entrepreneurs. While just 18% of men face difficulties in knowing where to source equity from, 40% of women say they are challenged.

Download Insights from Entrepreneurs for free

Find out how female founders have succeeded

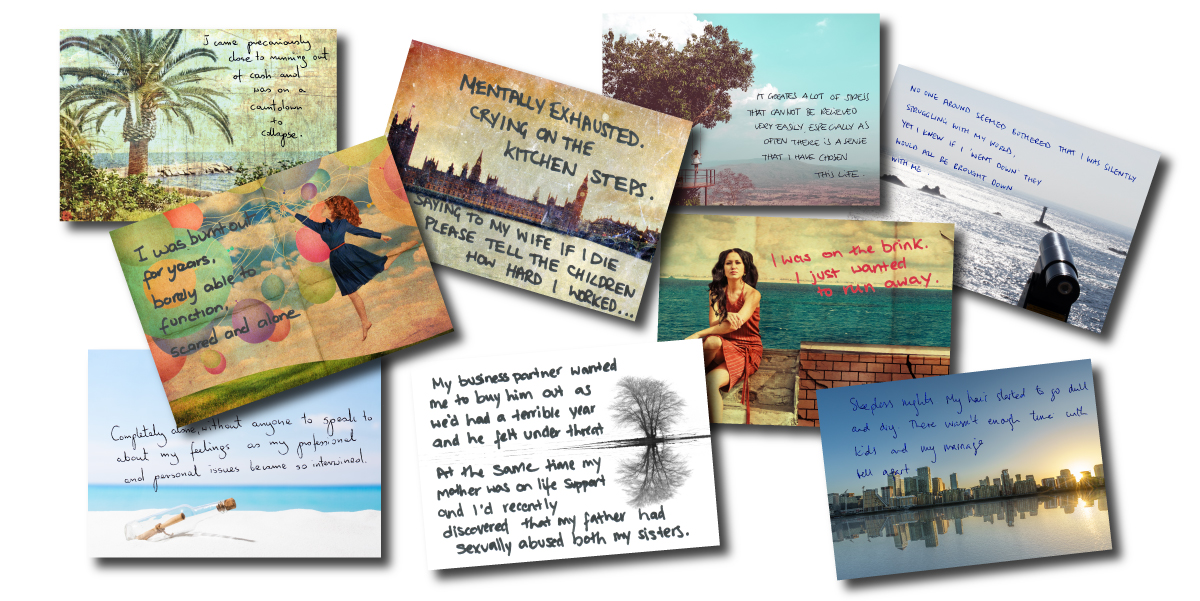

The 100 Stories of Growth campaign has spoken to many female entrepreneurs for our research studies and our extensive stories programme. We believe that stories have the power to motivate and inspire a generation of impressive entrepreneurs.

To celebrate successful female founders, we are sharing the ToucanBox story that features in the female founders section of the How they did it book along with a rich resource of entrepreneur growth stories. ToucanBox is an exciting tech-driven kids’ craft mail order business that has successfully tapped the equity markets to fund international expansion.

Download your free female founders book excerpt now

The British Business bank study shines a light on the reasons why female entrepreneurs feel they have fewer available options.

“It is shocking that nearly a quarter of VC firms did not see a single female founder at investment committee in 2017, and this needs to be urgently addressed. Similarly, just 5% cent of founding teams seen by VCs were all-female.”

Francesca Warner, CEO & Co-founder, Diversity VC

It’s clear that everyone in the SME community has their work cut out to redress the persistent gender imbalance when it comes to accessing all-important growth capital. The debate has rightly reached the top echelons of the SME community.

“It’s incredible that in 2019 men seem to have a virtual monopoly on venture capital. We need more investment going into start-up ventures and more women putting businesses forward. It’s in everyone’s interests that financing processes are open and meritocratic to grow the economy and make use of all the talent we have.”

Liz Truss, The Chief Secretary to The Treasury