Three UK real estate SMEs are breaking new ground

Somewhere to live, work and play. Real estate clearly has universal appeal. And the UK has some of the most solid foundations of any market worldwide.

Each year the real estate industry adds more than 50 million square feet of new space and contributes £94bn to the UK economy.

And the UK commercial real estate industry alone directly employs over 1 million people, according to the British Property Federation.

Small and medium-sized companies are booming, disrupting the industry with innovative tech and challenging the incumbents. They spot opportunities to excel that bigger property companies might have overlooked.

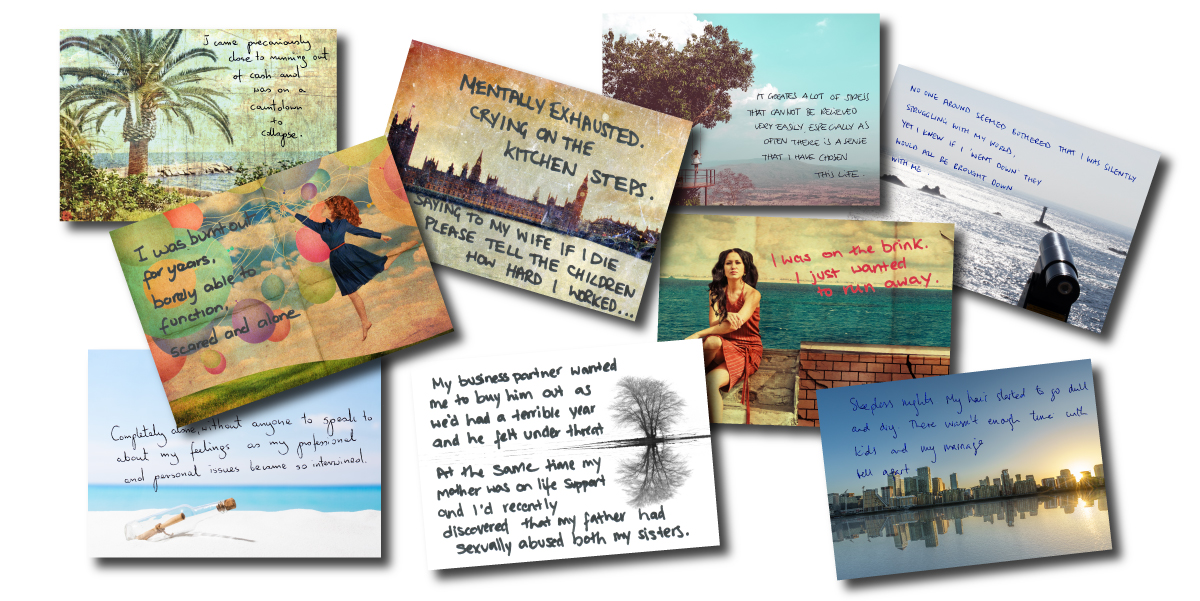

This week, 100 Stories of Growth campaign features three unique scale-ups. They are proof that real estate is a hotbed of innovation. Not only do they fuel the sector’s growth but they’re at the beating heart of the SME community.

The Office Group champions SME office spaces

Like a skyscraper reaching new heights, The Office Group has grown into an award-winning champion of co-working and office space solutions for SMEs in just 15 years.

Co-founder and co-CEO Olly Olsen says the company has been giving small businesses exactly what they want – fair prices, good quality and flexibility. Its sustainability focus gives it that contemporary edge too.

Building its solid reputation opened the doors to investors, meteorically fuelling TOG’s scale-up ambitions. Olsen says that the game-changing backing came in 2010 from Travelex founder Lloyd Dorfman.

He invested the money, enabled us to flourish, and connected us with business leaders across the UK.

This paved the way for a groundbreaking acquisition. Last year the real estate investment giant Blackstone bought a major stake in TOG, valuing the company at £500m.

Olsen and his co-founder and co-CEO Charlie Green are growing the property empire to headier heights. The real estate company is home to 15,000 tenants, mostly in central London, and generates a £76m turnover. [Read The Office Group story]

LendInvest takes on the might of traditional banks

How to swiftly disrupt a traditional sector? Co-founder and CEO Christian Faes knows the answer. His fintech real estate lending platform LendInvest is taking on the banks and has financed more than 4,500 properties.

With robust tech and diversified cost-efficient capital base, the company is creating a fresh approach to real estate finance. So far, LendInvest has raised over £760m of lending capital.

One of the funding channels Faes chose was a London Stock Exchange-listed £500m retail bond programme. The company has so far raised £90m with its first two issues of the retail bond.

Both issues have been great milestones for the business. They were our first public markets capital-raising, and we were the first fintech lender to raise a listed bond in this way.

Though LendInvest chose to scale up mostly without equity capital, in 2016 leading tech investor Atomico backed the lender. It brought a “huge value” in technology know-how, spurring on the company’s ambition to lead the alternative lending in the property sector.

With a steady growth and an annual turnover of £40m, Faes has his sights now on debuting becoming a leading lender in home-loan market. [Read the LendInvest story]

Earth Immo connects buyers and sellers in the global village

Geography and time zones haven’t been a hurdle as Earth Immo has continued with its global scale-up. The London-based real estate marketing company has been effectively connecting buyers and sellers in over 20 countries and growing.

Founder and CEO Dan Johnson attributes its success to the top-notch platform and a great human capital. The company generates a £2.5m turnover and has so far reached an audience of 100m people.

Great tech gives the company freedom to operate almost entirely remotely. The employees are fully trained, supported and monitored without ever physically visiting the London HQ.

Once that team member is up to speed, they fly the nest and operate in their own right.

Johnson would like to expand his business into new markets. He has an appetite for getting a share of the lucrative real estate markets of China and Middle East. To realise his ambition he will be looking for additional funding over the next year. [Read the Earth Immo story]